How to Estimate Conventional Loans Closing Cost

How much does it cost to buy a home? Purchasing your dream home can really drain the bank and knowing all your closing costs is extremely important to making sure you save enough.

How to Calculate Closing Costs?

I am asked all the time by clients, “How much will I have to pay for closing costs?”

Unfortunately, there is no universal ballpark figure or formula for this amount. Each situation and loan is different. Costs will vary by county, state, home owner association, lending company, and title company, just to name a few. That is why I always tell them to talk to their bank or lender to get a detailed estimate.

To help simplify some of charges you will see at the closing table, I interviewed Mike Boucher, a professional mortgage lender and native Houstonian, for Episode #2 of the “Good Things Come to Those Who Real Estate” podcast. He says, “When we talk about buying a home there are so many variables, and they all trigger different costs.”

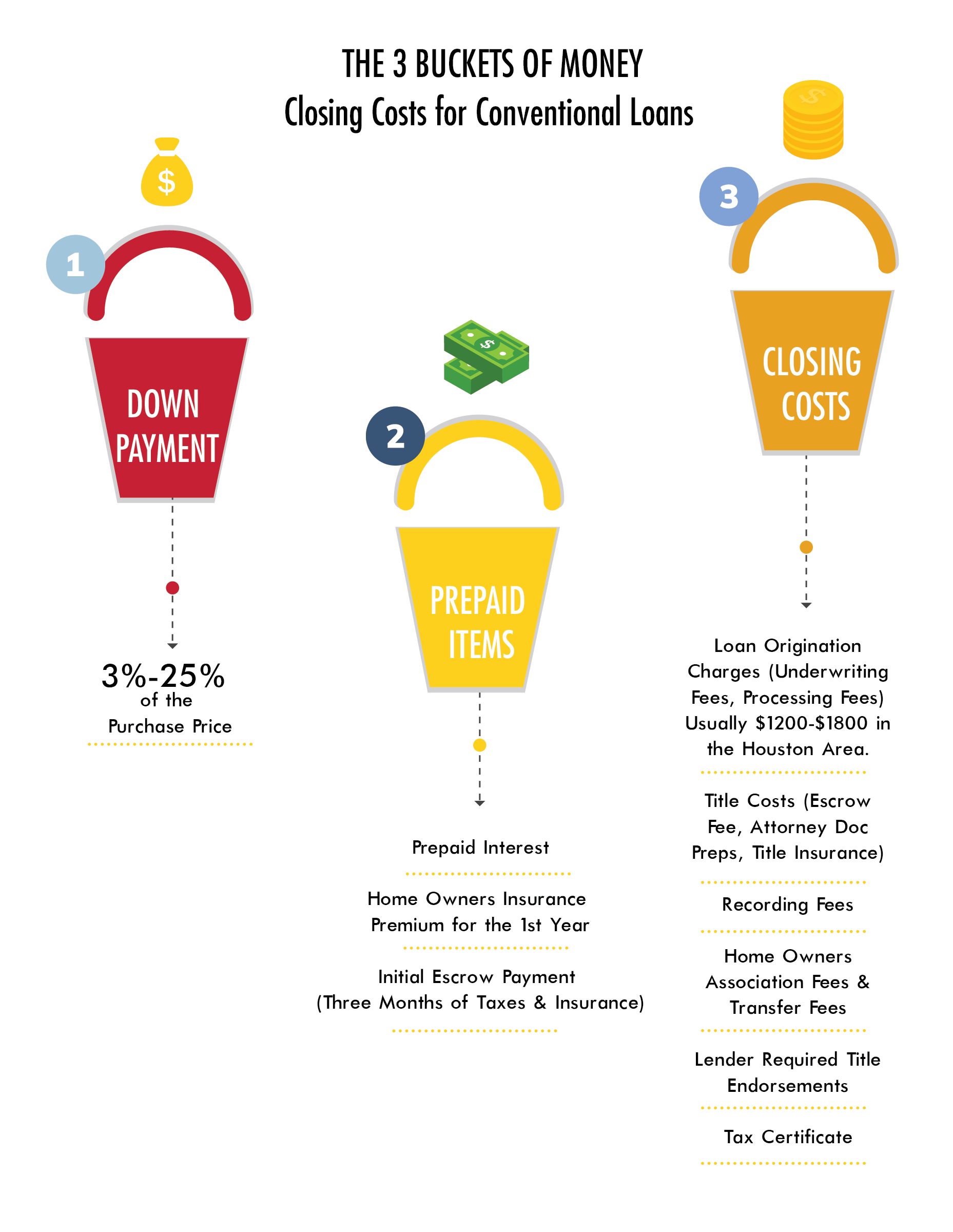

This former U.S Marine and all-round good guy, has a great system for breaking down the closing costs. He describes them as the “Three Buckets of Closing Costs.”

1. The Down Payment Bucket

Most people are aware of this bucket. A down payment is the amount of cash you pay as a part of the total purchase price.

A buyer’s down payment usually run between 5-10% of the price of the home but can be more. VA (Veteran Affairs) loans can be as low as 0% and conventional loans can run as little as 3%, but certain terms must be met.

It is paid out-of-pocket at closing and can come from pretty much any legal way you can scrape it together and believe me, it took my wife and I a “great effort” to scrape it together (two tough jobs, a side hustle, detailed budgets and lots of ramen…).

The down payment often has the most significant impact on the cash out of your pocket at closing. Some buyers may select to “buy down” their interest rate which means they will pay a portion of the interest at closing to give them a lower interest rate for the term of their loan.

Check out the example closing disclosure to see a buyer that decided to “buy down” their rate.

This is very beneficial if you plan to be in the home for a long period of time.

Some buyers are in the opposite camp and need help bringing money to closing. If so, these buyers may choose to have a higher interest rate and receive a lender credit to lower the amount of money out of pocket.

As you can see, your loan type, lender points and down payment amount will dramatically affect your closing costs in the “down payment bucket”. The good news is that you have control over these.

2. The Prepaid Items Bucket

The second bucket consists of prepaid items and unfortunately, you won’t be able to change these costs. Prepaid items are costs that need to be prepaid (Earth shattering information, right?) These costs include prepaid property insurance, prepaid taxes and the initial escrow payment.

Lenders require you to have homeowner’s insurance for the duration of the loan and many of them require you to pay for your first year’s insurance policy at closing. You can obviously shop for your home owner’s insurance so it’s a great way to save a little cash, but make sure you talk with a professional insurance agent to make sure you are not over or under insured preferred insurance agents.

Prepaid interest is sort of like your first payment just rolled into your closing costs. It is calculated from the closing date to the date of your actual first payment. It is common for the first actual payment to be made 1 to almost 3 months after the closing date depending on what day of the month your closing occurs.

The lender will also require you to prepay at least three months of property taxes, but it can be more.

Some home buyers may decide not to “escrow” their insurance and taxes, which is perfectly acceptable. That means that the bank is not taking additional monies out every month to pay your annual property tax and homeowner’s insurance.

This will make for a lower monthly payment, but homeowners will need to make sure they save enough to pay the insurance and property taxes when they come due. This option isn’t right for everyone.

3. The Closing Costs Bucket

Now we get into the 3rd bucket of money, which is the “Closing Costs” bucket. This is kind of a catch all bucket for title fees, lender fees, county & state fees and miscellaneous charges.

First you have your lender fees. According to Mike (have you watched the video yet? You better…), lenders in Houston tend to charge anywhere from $1,200 to $1,800 for loan origination. These are the actual costs that your lender takes on to qualify you and escort your loan through the process.

If you are closing in Texas or another state that uses title companies, then the title company will take their fees. The largest fee they charge is the title policy which is insurance against defects in the title. In layman terms, this means they will insure you incase another person or company has a portion of ownership or a lien against a property.

Title insurance is regulated by the Texas Department of Insurance and is the same across the board for all title companies in Texas. Check out the rates (sorry, it requires math… ☹) (https://www.tdi.texas.gov/title/titlerates2013.html)

More times that not, the seller will pay for the buyer’s title policy as a little incentive for you to buy their home. So that is a huge savings!

You will have to pay the title company’s escrow fee, which usually runs between $350 and $475 and this is the fee they take from the buyer and the seller to keep their doors open.

If you are buying a home in a home owners association (HOA) then you will have to pay the pro-rated HOA fee and oftentimes a transfer fee. Most people understand the annual or monthly HOA fee, but the transfer fee is not as well know. This fee is charged by the HOA management company to provide documents to the title company and to transfer the new buyers into the HOA records. Why this cost is $250 to $400 is an absolute mystery to me.

And finally, there are random fees such as a tax certificate fee, recording fee, lender and title company required endorsement costs, survey cost, appraisal cost and so on. Check out an actual Closing Disclosure to see what other fees are included or contact a professional lender to get a quote.

Find a Great Lender

I asked Mike if there was a closing cost calculator he recommended and unfortunately there isn’t one he would recommend.

He said, “Get in touch with a local lender, someone who is familiar with the market. Someone who is invested in a relationship with your realtor.”

So, if you are scraping and saving for the down payment on your next house, get in touch with your professional lender to get a better idea of your closing costs to make sure you have “scraped” enough.